What percentage do you ACTUALLY pay in Taxes… [Calculator Inside] | Tax Planning

When we talk about what rate we pay on taxes, we tend to focus on the highest bracket that our income may fall into. This is most likely because we are usually complaining (GUILTY!) and trying to emphasis how much of our hard-earned money the IRS requires us to fork over each year.

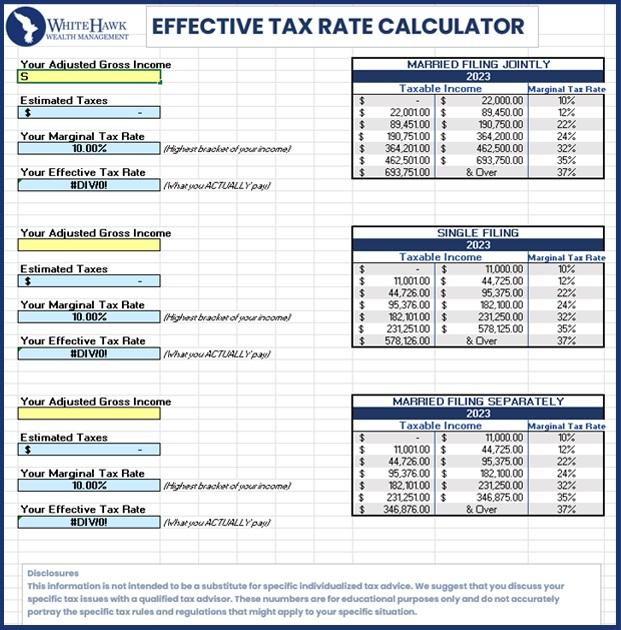

It turns out, that the percentage we actually pay (“Effective Rate”) is usually lower than the highest rate that we pay (“Marginal Rate”). We thought it would be useful if you had a tool that you could use to just calculate that rate for you without having to go through an online survey or sign up for another email list (since ours is ALL you need 😉)!

We have included below a free download for our spreadsheet that we created that will allow you to plug in an income number and automatically generate your marginal and effective tax rates.

BEST USE: Pull your Adjusted Gross Income (AGI) from your most recent tax return and put that into the yellow fields. OR you could enter the taxes you actually paid into the “Estimated Taxes” field along with your AGI and get a number that is close to the bullseye!

At the end of the day, the IRS is going to collect on some of the money that you have (insert “Death and Taxes” quote) and we believe that it can be helpful to know the facts before you start working on managing that lifetime tax bill!

Next up: Taking Employer Match as Roth?? Brand New Rules…

Disclosures

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment, tax, or legal advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.