Tax Buckets… what are we even talking about!? | Tax Planning

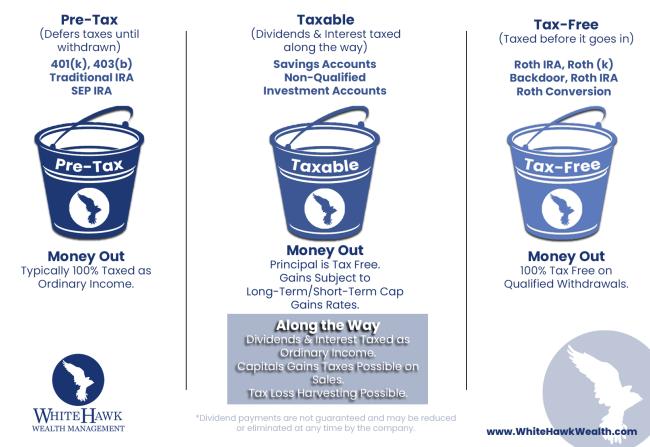

We love the idea of taking something complex and making it so that it is UNDERSTANDABLE. That’s the goal of using “Tax Buckets” when we talk about adding money TO investments and pulling money FROM investments. We created the diagram below to illustrate how investors contribute to some of the accounts that we are familiar with and how the taxes work on funds that go in. We also wanted to show how the same funds get taxed on the way out (and some along the way).

The graphic does not contain EVERY investment possible (real estate for example… taxable bucket) but should give you an idea of how your funds get taxed on the way into and out of different accounts. Now you need to know that we LOVE the Roth bucket… but why?

Without putting you to sleep with our spreadsheet showing the analysis of converting a Traditional IRA to a Roth IRA over 6 years and the long-term impact of the lifetime tax bill given very specific assumption…. Zzzzz

We lost you, huh? I think that we can all agree that having money that you can withdraw WITHOUT paying additional taxes is a BENEFIT. When we think about retirement, we must consider how pulling additional funds from accounts could create additional increases in Medicare premiums, Social Security, or any other “shadow taxes”. Additionally, that tax free bucket will not create a taxable situation for our heirs (discussed further down the road).

We have plans to help everyone that we can to shift assets to the Roth bucket as much as possible and within your comfort zone. Stay tuned for that and as always, please do not hesitate to reach out with any questions.

That’s all for this email. Next up: Is there ever a reason to NOT fill the Tax-Free bucket?

Disclosures

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.