Qualified Charitable Distributions (QCD’s) – What are they and their connection to RMD’s | Tax Planning

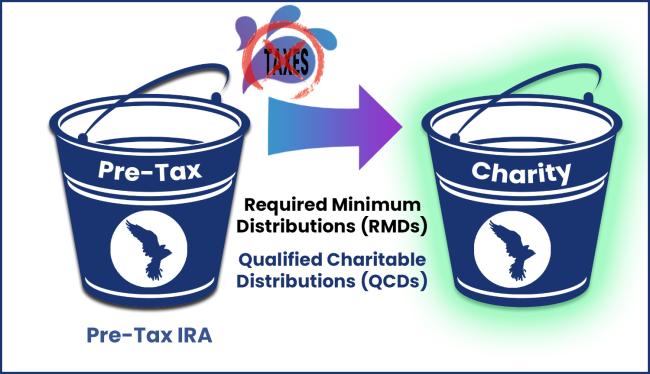

The IRS has created a rule that allows people that are age 70 ½ or older to transfer up to $100,000 (2024) to charity tax-free each year. For people that are taking Required Minimum Distributions (RMD’s) from their pre-tax IRA’s, these distributions count towards those amounts. If you believe in giving to charity and your pre-tax bucket is relatively “full” – please read on.

Normally, when you take distributions from a pre-tax IRA (Traditional IRA, for example) after age 59 ½ those distributions are fully taxable as income. With a QCD, those distributions are tax-free as long as they are paid directly to an eligible charitable organization by the end of the year. If both spouses are over 70 ½ years old, the transfer amount is $200,000 per year ($100k for each spouse).

This is a great option for those who are looking to give some assets away while they are alive and ultimately NOT pay the IRS in the process. As with every tax strategy, there are reporting requirements. Your tax preparer must be aware of your QCD distribution as it does NOT show as a different item on your 1099-R. The QCD will be “stamped” on the front of your 1040 by your IRA distributions to make the IRS aware of the tax-free distributions made to an eligible charity. MAKE SURE THAT YOU GET A RECEIPT FROM THE CHARITABLE ORGANIZATION.

Next up: Let’s talk about STATE taxes…

Disclosures

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.