Let’s Talk About STATE Taxes… | Tax Planning

You probably know that all states charge different income tax rates (or some NONE at all!). What is interesting is that some states charge 0% state tax, some charge a flat percentage, and others base the rate on how much income you make (just like the Fed). The percentage and type of income tax that you pay for your state is very important to tax planning.

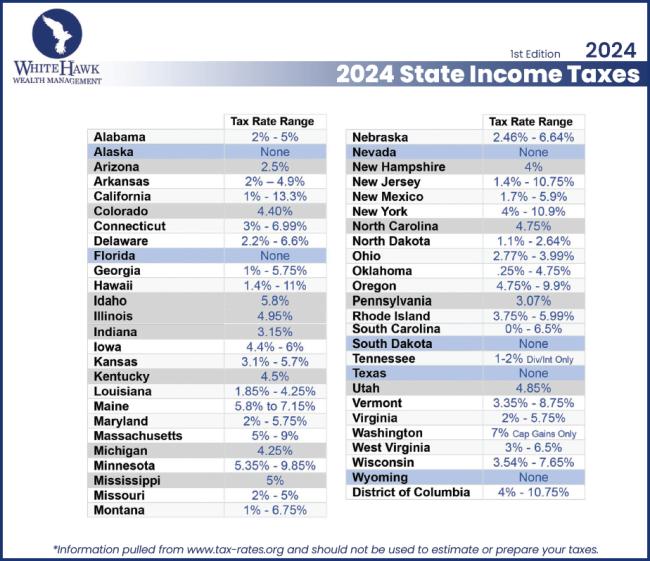

As you can see from the backside of our 2024 White Hawk Wealth Management Tax Guide (above), there are currently 6 states that do NOT charge income tax. All of the other states have income tax rates ranging from 0% all the way up to 13.3% (New York holds that title).

How does this impact tax planning? If you are planning to retire to a different state, you would want to compare your income tax rate in that state versus your current state of residence. For example, if you live in Colorado and are considering retirement in Florida because you are tired of the winters, you will notice that Colorado has a 4.40% income tax rate compared to the 0% income tax in Florida. If we are planning ahead and considering accelerating your income (Roth Conversions), we would need to carefully consider the fact that you would potentially pay LESS taxes if we waited until you moved to Florida. The opposite would be true if you were moving from Florida to Colorado – we would look at potentially being more aggressive with accelerating your income prior to your move.

This is fairly advanced planning, but we have had it come up with several of our clients across the country. It’s important for your financial professionals to understand the tax impacts on your specific situation and plan accordingly. That’s one of the reasons why we are reviewing your tax returns and always making sure that we have a good understanding of your plans for the future.

Next up: “Kiddie Taxes” – is your child (grandchild) the next Warren Buffet?

Disclosures

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.