How the Tax-Free Bucket Can Fund Long-Term Care + “Shadow Taxes” | Tax Planning

When it comes to Tax Planning, we are always looking into the future. We work with our clients to pursue fun financial goals like traveling the World, remodeling their home, or sending grandchildren to college. We also attempt to plan for the unexpected things like Long-Term Care events (needing help with 2 or more Activities of Daily Living or cognitive). When unexpected events happen to our clients, our challenge is where do we get the funds to cover the expenses?

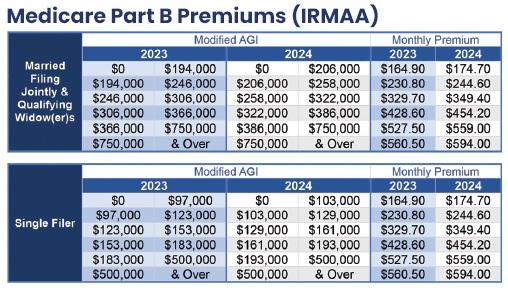

If most of your money is in the Pre-Tax Bucket, the ramifications of pulling extra money out can trigger what we commonly refer to as “Shadow Taxes”. For example, the Medicare premiums that you pay are based on your taxable income (see image below). Any time you withdraw funds from a pre-tax account, you are effectively increasing your taxable income. So, you are in a situation that you need to fund long-term care and need to pull funds from the pre-tax bucket, you could unknowingly be increasing your Medicare premiums at the same time! Depending on your income level, your Social Security income benefits could also be taxed as a result along with the obvious increase in your taxable income which could be putting you into a higher tax bracket.

With careful planning, you can GET AHEAD of the ticking time bomb that is the Pre-Tax Bucket. Qualified withdrawals from a Roth Ira (Tax-Free Bucket) will not add to your taxable income nor will it trigger any shadow taxes. You could also pull funds from the Taxable Bucket but will need to consider the potential capital gains consequences. There is no wrong time to be reviewing your tax returns and looking for opportunities to shift funds into other buckets. There are a lot of moving parts when it comes to tax planning and our goal is to help you understand them at a high-level so that you avoid “tipping the IRS” without meaning to.

Next up: Did you ITEMIZE or take the STANDARD DEDUCTION? (and why it matters!)

Disclosures

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.